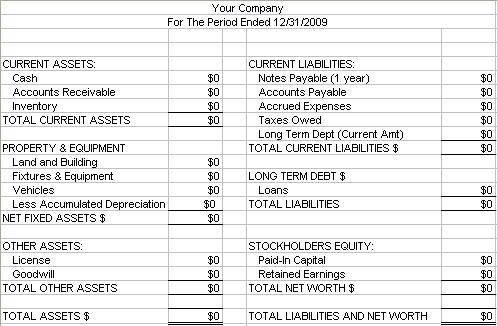

Make a Balance SheetBelow is a step by step instructions on how to Make a Balance Sheet. Other pages on this site have told you what is on a Balance Sheet, what heading are used and what goes where. Now it's time to take that knowledge and make a balance sheet from scratch. Lets walk through a few transaction so you can see how they effect the balance sheet step by step. I'm not going to get into debits and credits here, that's for another section, just an explanation of a transaction and where it goes on the financial statement. First, we start with the same blank Balance Sheet used in other pages.  Now, lets look at the effects of the following transactions:

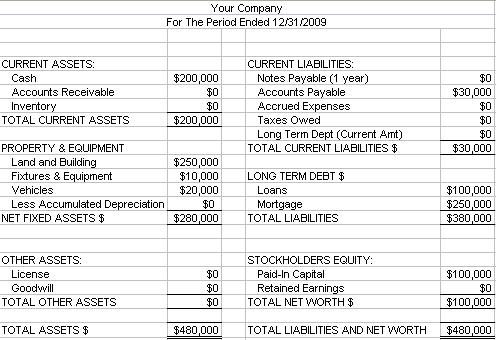

You can see that on the asset side cash (Current Asset) has increased by $200,000, on liabilities the loan (Long Term Debt) increased by $100,000, as did paid-in capital (Owners Equity). Next,

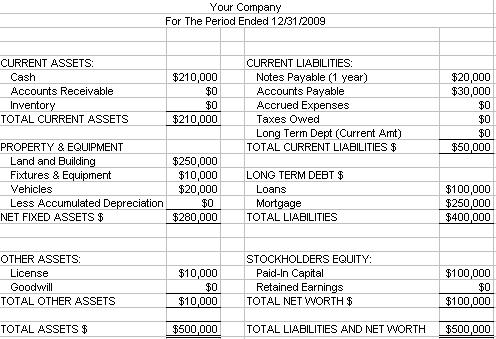

Under Property and Equipment the building, equipment and the car values are found. Over on the liability side are the mortgage under long term debt, and the car and equipment payable amounts are a current liability as they will be paid within one year (assumed to be an operating cycle). Final Balance Sheet transactions:

The $10,000 Patent falls under Other Assets, cash is reduced by the same $10,000, no change to Total Assets. For the Note Payable, the money goes into Cash, on the liability side you can see Notes Payable for $20,000 under Current Liabilities. This is an example of a business raising money, investing in captial, and preparing for operations. Once operations actually begin, the Income Statement comes in and amounts flow to the balance sheets from sales, expense, net income, to name a few. We will take up these transactions in the Income Statement sections, where you will be able to see it all come together. Click here to leave the Make a Balance Sheet page and return to the Balance Sheet Understanding page, where more important Balance Sheet information can be found. |